Learnings From Stanford GSB: Wk6

- Dylan Pathirana

- Feb 25, 2024

- 13 min read

In this week's lectures, we covered the founding a company and discussed how to divide equity and what company structure to use. Later in the week we had a lecture on economics.

Founders, Pay and Equity

What is a company?

A company is a seperate legal entity, which essentially means it is considered as its own 'person'. This means that it has its own rights and responsibilities. Companies are formed in order to conduct business activities, both for and not-for profit. Being a seperate entity has many benefits such as personal liability protection, tax benefits and many more that we will discuss throughout this article.

There are many different company structures all with different benefits. A good summary is available here : https://www.businessnewsdaily.com/8163-choose-legal-business-structure.html

For a very high level summary:

Type | Limited Liability | Tax Rate | Complexity | Ease of investment |

Sole Proprietor | No - individual is liable | Personal Income | Low | Unable to issue shares |

LLC | Yes | Personal Income | Medium | No shares, can only sell an interest stake |

S-Corp | Yes | Personal Income | High | Can sell shares to US citizens |

C-Corp | Yes - Highest protection (federal recognition) | Corporate tax rate | Very High | Can sell shares to anyone |

When should you form a company

So, you have a grand idea and you are ready to become a unicorn, but when should you actually start a company? Given a few of the benefits mentioned above, the formation of companies is usually triggered by a legal or economic concern. A few examples could be:

You have intellectual property (IP) that you want to protect or transfer from a singular cofounder

If one co-founder owns the IP under their own name, whats stopping them from running away with it and starting their own company? It is better to transfer it to the company, that way all co-founders have peace of mind, and the IP will outlast all the co-founders.

Founders want to limit their personal liability

Imagine you develop a prototype and sell it, but it doesn't work properly. Your customer sues you and you lose everything. Instead, if a company is formed, the customer could only sue the company and only the company's assets could be under threat, not the founders (In most cases)

You are seeking funding

VCs are lining up to invest in your idea, but what will they invest in if you don't have a company? They can't buy shares in you (or at least I hope not). By starting a company, you are able to issue shares in a legally binding way, which allows investors to have security over their investment.

Tax Benefits

Until you start a company, all the income you generate from you 'business' is channelled through your personal income and as such, gets taxed at your personal rate. If you start a company, the income goes through the company and is taxed at the company rate.

Getting business credit

A bank is much more likely to give a loan to a company or a partnership with multiple founders (Multiple credit histories they can assess)

What are the reasons you shouldn't form a company

Given that you can technically incorporate for under $100 using some online tools, it may seem like you should just incorporate every idea you have. There are however a few reasons that you should consider before officially starting a company.

Are any of the founders subject to restrictions such as NDAs or Non-competes?

If your founders or employees are under non-compete agreements, it may be beneficial to not start your company until these agreements have expired. This will reduce the chance of a suit being filed against you for breach of these agreements.

You should also check to see if there is any IP owned by a third party, such as a university

Let's say you made some findings while working as a researcher at a university. They may actually have a claim to a company that you start based on these findings. Many universities have full ownership of all IP generated by employees over the course of their employment. It is important to check that none of your company is based on any information which may be protected under these clauses. On a side note, there is also value in clearly tracking and documenting your findings through a lawyer if you think there is any chance another institution will try to lay a claim to the IP.

Is there value to me working on this in 'stealth mode'?

When you are a company, you have to submit mandatory filings which can be seen by your potential competitors. By staying unincorporated, you have the benefit of flying under the radar and not alerting competitors that you are working on something.

Cost of getting it done right

Whilst you can incorporate online using a generic tool, there is benefit to consulting a startup lawyer in your industry who will have specialised advice to set your company up with a future-proof structure

How do you actually start a company

Starting a company usually starts with finding a lawyer to actually prepare and file the incorporation documents. There are a few key things to remember when choosing a lawyer:

Look for a lawyer who understands and has experience with startups

Ask other founders or VCs in your industry for referrals to good lawyers

You are hiring the lawyer, not the firm

They will be very important for your funding, so look for someone who is well connected. They will be able to make a lot of introductions.

Look for someone who is interested in you and your idea

Make sure you understand their fees

Tips:

Remember that you company lawyer represents the company, not you individually. They will not be looking out for what is in your best interest. Also get a personal lawyer!

When incorporating, issue a large number of shares ~100million. This will make the pool big enough and has the psychological impact of making people feel like they own a lot.

State of incorporation?

Many startups talk about being a Delaware C corp, but why does location matter?

Many VCs will only invest in a company if it is a Delaware C corp. If you have incorporated somewhere else (i.e. New York C corp) or need to re-incorporate, you are setting yourself up for a large amount of additional legal costs. In addition to this, the Secretary of State automatically reviews and approves funding filings, which can take weeks in other states.

Delaware is a very pro-business state, where there is a seperate court system for business cases to be heard. The judges usually vote in favour of the company and there are no juries. Since claims against a company are heard in the court of the state in which they are incorporated, there is great benefit to being a Delaware C.

Low cost

Low annual filing fees

Initial incorporation only costs $90 (for the actual filing)

Equity

Vesting

If you and your co-founder decide to start a company and you split the company equally (we will discuss this later), what's to stop your co-founder ghosting you and waiting for their shares to be worth a fortune? That is the trouble with giving stock up front. Instead, vesting is often used. It is the process of issuing portions of allocated stock over a period of time. For example: 25% after the first year, 25% after the second year and then 25% per year distributed monthly. It effectively trickle feeds allocated stock to incentivise people to stay engaged and work for their share.

Acceleration Clauses

Vesting is great from a company perspective as it keeps employees and founders motivated and invested. But what if you are one of those employees and 5 days before you are supposed to get you 25%, the company fires you? All that work for nothing? That is where acceleration clauses come in. These outline how the vesting schedule may be brought forward based on triggers (such as early termination).

Types of Stock

Common Stock

Common stock represents partial ownership rights of the company. However, common stockholders cannot demand a dividend and are the last to get paid in a liquidity event.

Preferred Stock

Preferred stock has additional benefits compared to common stock (most preferred stock converts to common stock in the event of positive liquidation, but this is spelled out in the term sheet). Not all preferred stock is created equal. Each type comes with its own rights, such as higher liquidation preferences, anti-dilution or non-vesting. This makes them more attractive to venture investors.

Dilution

Let's say you start a company and it has 3 founders including you. You divide the equity equally, so you all get 33.33% of the company. When you need funding, you go to an angel and they want a specific share of the company for their investment. In this case 33.36%. What actually happens is that your company issues more shares that are transferred to the angel, but since there are more shares in the company, the founders percentage share goes down. This is the process of dilution. You might be asking, why would anyone agree to reduce their equity? The hope for the founders is that the value of the company will increase with this angel investment. Would you rather 100% of $1000 of 1% of $1B?

Who is a founder?

It is the trend right now to be a 'Founder', so you might be thinking, "what additional perks do they get?". There is actually no legal definition of what a founder/co-founder is and therefore they get no special privileges from a legal standpoint. There are really two types of founders:

Initial Founders

Those who are in attendance for the founders agreement or incorporation.

This is largely because they have a say over the type of incorporation, the equity splits, the titles and the issuance of founders stock.

Symbolic Founders

Think about Tesla, Elon Musk is a great example of a symbolic founder. He did not join the company until nearly a year after it was incorporated and yet he is known as co-founder (even though most people think he started it). However, he made a significant investment which helped bolster the company and so he was named as a cofounder.

How to align with a co-founder?

Many people in the valley say that picking your co-founder is just like getting married, so it is important that you are both well aligned. Whilst it is beneficial to have previously worked together, there are some key questions that you both should discuss to prevent disputes down the line.

What are our goals for the business?

What are our commitments?

What happens if one of us wants the leave or sell the company?

What happens if things don't work out?

What are the criteria that will cause us to shut down the business?

Equity Split

Whilst splitting equity between your co-founders may seem like the most fair solution, it is often just the easiest solution to avoid have that tough talk. Investors will see this. If you are unable to have the hard conversation as a team now, then what will your team do when things get tough? That is ultimately what is running through the mind of an investor. Studies have actually shown that companies with equal equity splits are less productive/efficient. You should focus on assigning equity in a quantifiable way, based on value creation. This will ensure that everyone is sufficiently motivated and rewarded.

One method to achieve this is to get the founding team to sit down and create the following chart. Write the headings done and To be done in two seperate columns. Then, pass the page around and fill in what work fits into each column.

This helps to visualise how much value has already been created, vs how much there is still to do. The team should then assign names to who is responsible for each piece of work/milestone. This will allow you all to align on where the value lies and who will be responsible for providing it. You might get to the end of this exercise and realise that one founder has much more assigned to them and therefore they deserve more equity. This is a simple method of helping the entire founding team come to an agreement on equity split, based on actual value creation. It may also highlight the fact that your current team is not equipped to meet the future roles required to realise growth and outside capital and

Ultimately, it is advised to pay and give equity based on the market rate. This reduces clashes between co-founders and ensures that no-one is worse off based on their skillset.

Founder compensation

Cash compensation of founders can be an important statement in the beginning. It sends a signal the rest of the organisation and to investors. Are you thinking long term and taking a small salary or are you thinking short-term and taking an above market salary. It also signals whether you are frugal or free spenders, and whether you value equality or hierarchy. This doesn't mean you shouldn't take a salary, just be aware of the perceptions. Differences between founder's salaries should be used as a means to compensate for the imbalance in current roles and responsibilities, while equity is more of a long-term mechanism.

Establishing guidelines

In the early days, it can be easy to just hire who you want and pay whatever you need to get the best people. However, it is important to think forward and build a hiring and compensation guideline early. It should outline your hiring process and the way you will compensate different roles. By doing this, you can reduce employee resentment over pay and equity

Economics

Game theory

Game theory is the analysis of strategic situations between independent and competing players. It is used to assess each of the possible outcomes and determine which is the most likely one. It is a tool to help aid decision making, ultimately aiming for the best outcome or the most economically efficient outcome. True economic efficiency is all about maximising the TOTAL value created, regardless of how equally it is distributed. This could mean one party gets $100 and the other loses $500, but it is better than both parties losing $1000. However, reaching an economically efficient outcome is not that common.

Information asymmetry is one of the key drivers that reduces economic efficiency. If we knew everyones reservation prices, we would be able to allocate resources efficiently. This happens since people often don't know their true reservation price or are unwilling to share in fear of being taken advantage of. We discussed an example of how a simple question can improve economic efficiency. Let's say you are buying a car. You should ask the dealer if they receive a kickback if you buy the car on a lease. If they say yes, ask to split the commission in exchange for you buying the car through a lease. This way, there is a reduction in information asymmetry and in increase in total value generated.

Reputation

Reputation is very important as it ties past behaviour to future behaviour. It is one of the most important assets you can have since it gives you credibility. People are often too scared to sell themselves, but will talk extremely highly of others. In interviews, this is a massive disadvantage. Employers are looking to understand your reputation, so it is your job to lay out your achievements so that they can project future behaviour.

A great example of how reputation can be used against you is Katherine Graham, who ran the Washington post. She was the first woman to lead a fortune 500 company. Amongst the unions, she had a reputation of always caving to their demands. Back in the day, employers could make a “Final Offer” to the union before the matter would be escalated to the National Labour Relations Board (NLRB) where the offer would be examined and if it was found to be reasonable, the union would be disbanded. After some riots during the union’s strike and the killing. of one of the foreman, She knew she had to take a stand. She made the union a final offer (which normally would end up getting re-negotiated) which gave them most of their demands except she also said that the person who killed the foreman must be turned into the police. Not wanting to turn in one of their own, the union rejected the offer, expecting Katherine to come back to the negotiating table based on her reputation. However, she escalated the offer tot he NLRB, where they had no choice but to disband the union.

Ultimately, game theory has very logical outcomes, but humans are not logical. Therefore, it is critical to have empathy and try to gain an understanding of the other party. This will maximise your chances of obtaining the best outcome

Games

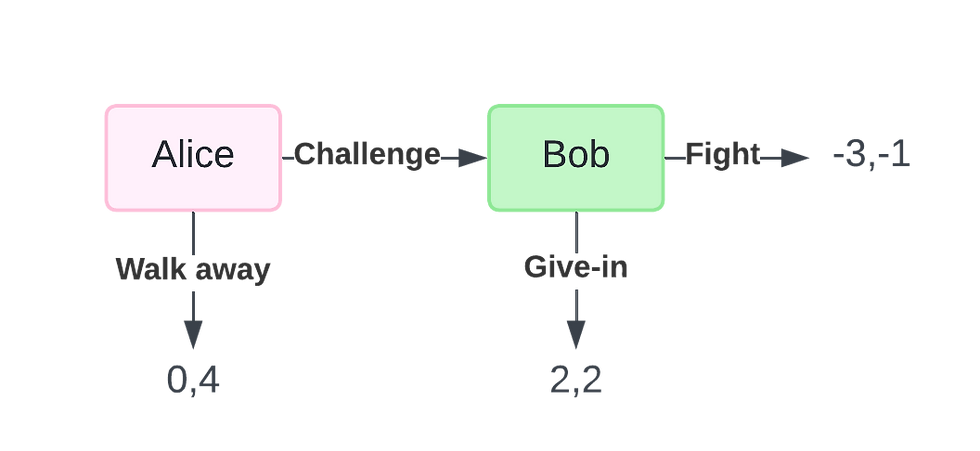

Threat game

In this game, there is a reputation element. Alice is largely making her decision based on what she thinks Bob will do. It may seem counter-intuitive for Bob to ever fight because mathematically it is the least efficient outcome. Both parties lose. However, think about what happens to Bob's reputation if he gives in. He will build a reputation of being easily pushed over and this will attract more competitors. If he fights, yes he will lose money/resources, but he will send a clear message and build a string reputation. The fight outcome also has more of a negative impact on Alice, which may be a factor in Bob's decision.

Promise game

In this game, the most efficient outcome is for Alice to Trust Bob and for Bob to be honorable. This generates +2 value. However, if we start with Bob's decision, it makes more sense for him to be deceptive as he gets a higher return. If this is the case, then Alice is better off not trusting Bob in the first place. This is another game in which reputation plays a large role. If Bob is known to be honorable, then Alice has a much higher likelihood of trusting him. This point is further reinforced when this game is played anonymously. Many people choose not to "trust" because there is less accountability and they don't know the reputation of the other player.

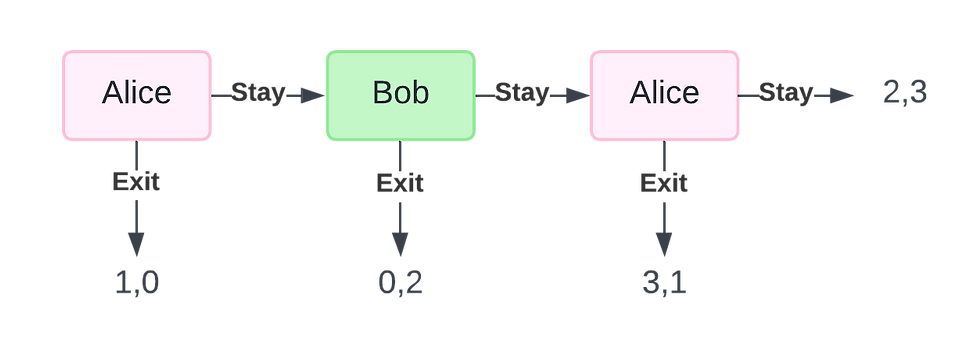

Short Centipede Game

In the centipede game, the total value created increases with each round, but each player has the opportunity to end the game and take a more favourable share of the money. This game really highlights the conflict between self-interest and mutual benefit.

If we do backward induction and work backwards, we ultimately find that it is mathematically not worth Alice ever starting the game. That would be the rational thing to do.

If Alice does join the game then Bob can deduce that she is irrational and therefore it is likely she will continue to play and therefore it is worth bob playing. But then it becomes the rational thing for Alice to know that Bob will think like this and so it was rational for her to start the game in the first instance and then exit. Hopefully you can see there is a cycle of rationality and irrationality that makes it incredibly difficult to understand what the other party is likely to do.

Coordination game

In this game, each player can choose to play safe or risky. By playing safe, they guarantee a positive outcome, but they could earn more by playing risky. There is incentive for both players to play risky, but these leaves them open to miscoordination, which would result in a negative outcome for one of them.This game shows the importance of communication. If both parties clearly communicate what they are gong to do, then a mutually beneficial result can be achieved. Even if it is not the most efficient solution, you can minimise loss by making sure you both choose safe or you both choose risky.

Correlation vs Causation

It is very easy to see focus on data when you see it. However, if you look too much at the data, you will be mislead. You need to focus on looking for causation and not correlation. Ask yourself why something is happening and don't just assume that the data means something.

Key Takeaways

For me, there was two key takeaways from this class:

People are irrational - The decision that seems logical may not always play out

Reputation is very important -> Build a good reputation and avoid compromising it

Comments