Learnings from Stanford GSB: Wk1

- Dylan Pathirana

- Feb 12, 2024

- 8 min read

First week, in a new city, on the other side of the world. It has been incredible. For those who don’t know, I am currently at Stanford doing a 2-month certificate program called ‘Ignite’. Essentially it is a business and entrepreneurship course designed to teach the frameworks to take and idea from 0 to 1. As well as benefiting my own learning, I wanted to write a summary at the end of each week to help share my key takeaways.

Succesful Entrepreneurs

There is a difference between entrepreneurs and successful entrepreneurs. During our class discussion we broke down the key aspects that make a founder successful. We arrived at the following:

Visionary — A visionary has a deep understanding of the need they are solving, the customer and the technology. They are able to visualise how to ‘connect the dots’ and see a greater opportunity

Ability to commit & Re-commit — Successful founders need to be able to hold firm and follow their vision, but also have the humility to accept when you are wrong and quickly re-commit to a slightly different path.

Lower Risk Aversion — Entrepreneurs have a lot less risk aversion, meaning they are willing to take bigger risks, but successful entrepreneurs are slightly more conservative compared to this. They have the ability to think deeply about outcomes and ensure they are always moving towards their vision.

Self-Awareness — Ability to understand your key strengths and weaknesses, as well as what you want out of the venture. Successful entrepreneurs partner with others who complement their skillsets and compensate for their weaknesses. It’s also important to know what you want. Some founders may not want to lead 1000’s of people and so will make the decision to exit after building the business to a certain level.

Desire for power and control — Successful entrepreneurs are highly competitive and want to build the best product. Having this trait also gives you the belief that you can actually create change within the world, which gives you the drive to do great things.

Willingness to undertake Personal Sacrifice — By making sacrifices to achieve their visions, successful entrepreneurs show their true character and their ability to get through tough times, something which is bound to happen. This is a metric which investors often look for, as the resilience it proves, has great correlation to longterm success.

Persistent in solving problems — Having the discipline to be constantly working on

solving problems that are important to the founder. Entrepreneurship is not a ‘one and done’ mindset. Once you have the itch, you will never get rid of it. Successful entrepreneurs are always looking at problems around them and creating solutions to solve them.

Fully Immersed — Having the ability to go all-in and understand all the details of what you are working on. Having this understanding across disciplines enables you to help solve challenges across the board.

Connecting the dots

Successful companies often aren’t the first to come up with the product, they are the first to connect the dots. Apple weren’t the first to make an MP3 player, they were the first to see the opportunity for an elegant device, but also downloadable music. iTunes was the real innovation. A marketplace for music, in your pocket. Something that became so highly demanded, that Steve Jobs reversed his promise that he would never build products for windows and released the iTunes for Windows.

This was probably my biggest takeaway. Don’t just look at the current trend or leading technology and try to do something in that space. You will be attacking a crowded market. Instead, look for opportunities to support this emerging trend. For example, McAfee antivirus saw the rise in computers and software, but also saw the opportunity to distribute software online. The company ‘connected the dots’ and created a software distribution model which shifted us away from CDs and Floppy disks, to online downloads.

Venture Capitalists

As founders, partnering with a VC is often seen as selling you soul to the ‘devil’. It is important to understand what VCs do and where their motivation comes from in order to assess if they will help or hinder your venture. I found this discussion incredibly insightful as all I had previously known about VCs was from movies and hearsay.

Roles of a VC

Get pitched ideas from Entrepreneurs

Sit on the board of directors for some of the companies they have invested in and advise their founders

Report to their Limited Partners (LPs)

It was this last point that really struck me. At the end of the day, VCs are fund managers. They need to meet with their investors and manage reporting. Ultimately, they are just trying to please their LPs. So when they are pushing for extremely fast growth within the ventures they fund, it is largely because that is what they have sold to their LPs. These LPs are often big superannuation or pension funds who are looking for diversification in their investments. That is why they commit a portion to VC, but they do this purely expecting high risk, high reward investments. This has given me a much greater appreciation for the motivations of VCs and will definitely influence how I pitch ideas going forward.

Marketing

It is vitally important that you understand the problem first. Without this, you will be aimless and may develop solutions which solve non-problems. Always have your target customer in mind

Understand Customer Personas

One of the keys to market is to really understand who your customer is. To do this, you need to interview prospective users and really understand what it is that they are struggling with and how they currently interact with the problem.

Market Segmentation

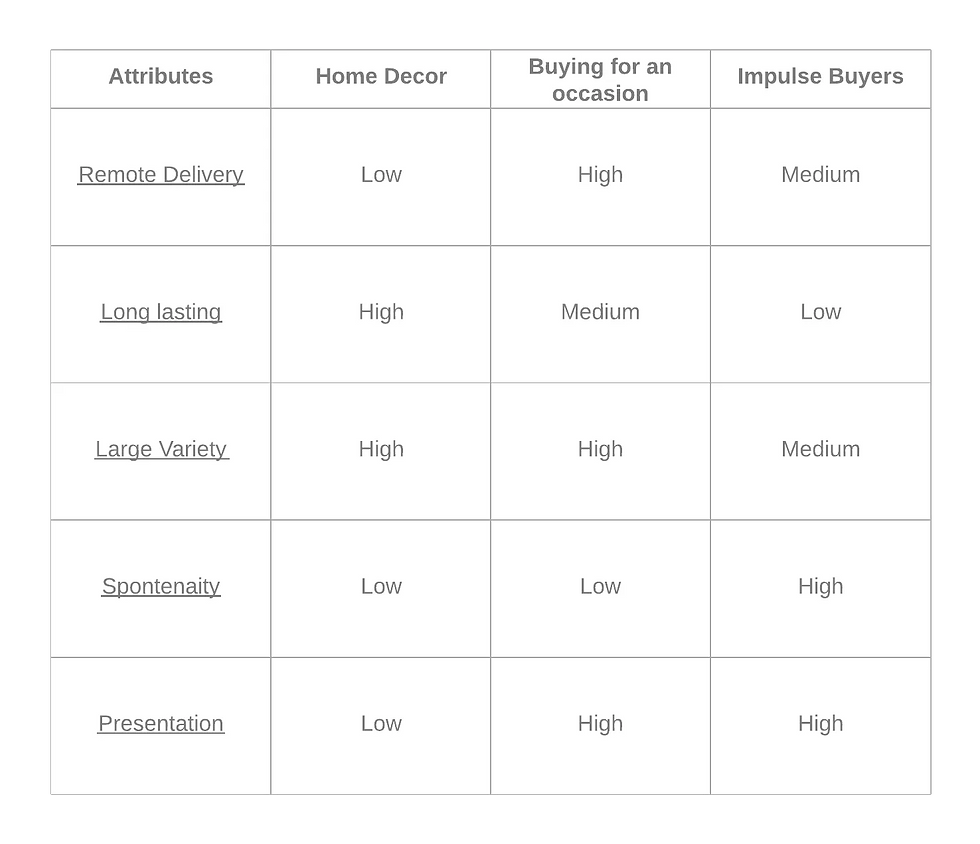

Many people may want your product or service, but there will be groups of them which care about different features of your product. Each group will have a different weighting for each value category. For example, some people may prefer a lighter-weight product and would be willing to pay more, whilst others would be indifferent about weight but want it to be low price. This is known as market segmentation.

It is important to segment based on benefits rather than demographic. Demographics often have the advantage of being addressable, but they are weak predictors of preference. Instead, identify target market segments based on attitudes and behaviours.

Making a segmentation matrix can help identify the segment that you should be chasing. Below is an example for a flower delivery service.

Identify your Value Proposition

It is very common in this phase to amalgamate multiple different market segments. Don’t. Just pick one market segment which has the best fit and focus on them. Later down the track once you have gained traction you can add more segments. It is also important to find a meaningful difference between your product and your competitors, and promoting that difference.

The two key factors here are Market fit and your Point of Difference

Positioning

Positioning is what you do to embed your product in the minds of your users. Essentially how they remember your product relative to the competition. Effective positioning establishes a frame of reference, essentially the category you are in, before highlighting points of parity with similar products. By highlighting parity, it essentially gives you access to the club and provides some level of credibility. Then, you should highlight your differentiation, to show people why they should choose your product over the rest. This process can be summarised in a positioning statement. This should include:

Who your target customer is.

What problem you are trying to solve

How your product solves the problem

Why your product is better than competitors

This process is all about helping people to visualise your product and its benefit. This process will have multiple drafts as you learn more about your customers and product, but that’s ok.

Again, make sure your “who” isn’t too general as it will reduce efficacy. Find a general pattern of users from your market research and stick with that.

Go-To-Market

You have to find where the people you are targeting are and what you have to do to get to them.

One key takeaway for me was Inertia. As entrepreneurs we are often trying to do something revolutionary. However, most people are reluctant to embrace change. This is a huge challenge and the GTM strategy is key to breaking through changing peoples mindsets, allowing them to try your product and hopefully fall in love with it. One way is looking at the ‘Economic Value to Customer’ (EVC). This is essentially an economic comparison between what your users do now to solve their problem and what your product costs. By promoting the extra value that your solution provides to the customer, it can break past concern of higher upfront cost and shed light on what they are actually spending now.

Accounting

This session was all about understanding the 3 key financial statements.

The Balance Sheet

The Income Statement

The Cash Flow Statement

These are important to understand as they are often a key metric to capital providers who look to invest in your venture.

Balance Sheet

The balance sheet shows the companies Assets, liabilities and equity at a point in time. It is governed by the balance sheet equation:

Breakdown of the balance sheet equation

This figure also highlights the capital structure of the company, essentially where its money is coming from. Different companies will have different strategies and as such, different capital structures. If I prepay for an air fare, you may think this can be booked as Earned capital, but since the company has not yet provided me the service I paid for, it is booked as borrowed capital until I actually take the flight. At this point, they have fulfilled their obligation and so it becomes earned capital.

One key fact is that Intellectual Property and Intangible assets are not listed on the balance sheet, unless they have been acquired. This is due to the fact that it is very difficult to value. This is very important to consider given that many companies now are in tech and as such their major value may be an intangible asset, which will not be shown on the balance sheet. This was the case for Whatsapp before it was acquired by Facebook. The company’s balance sheet showed assets equalling $50m and liabilities totalling $60m. This values the company at -$10m, but yet, Facebook paid roughly $22 Billion! This is largely because Whatsapp’s value was in it’s users, which aren’t reflected on the balance sheet.

Whatsapp’s balance sheet before it got acquired

However, if you acquire a company with intangible assets, then you are able to add them to your balance sheet. This meant Facebook was required to add their valuation of Whatsapp to its public filing. This provides an interesting case where there is more incentive for companies to acquire new technology than to develop it in-house, as they are then able to book it’s value to their balance sheet.

The problem with the balance sheet is that it doesn’t explain why values are changing between each snapshot. That is the role of the income and cashflow statements.

Income Statement

The income statement shows the revenues earned and the expenses incurred by the company during a period of operating activity. It helps to highlight income increasing and income decreasing activities.

Under accrual accounting revenues can be booked once the agreements of the contract have been fulfilled. You don’t have to wait until the money hits the bank account. This means I can book revenue once I supply you goods, even if you will not pay me for another 30 days. When you pay me, The income statement will not change, but the cashflow statement will.

Cash Flow Statement

The cash flow statement reconciles the companies cash balances at the end of the previous period with the balance at the end of the current period. It highlights the main sources and uses of cash.

There can be differences between the cashflow and income statements since cashflow increases as soon as money is received, while the income statement only increases once the obligation or contract is fulfilled.

Key takeaway: The financial statements only reflect things which have a reliably measurable economic impact. This means that companies with a lot of intangible assets will have financial statements that do not reflect their real value.

Financial Statement Analysis

If you see a company with a huge amount of cash, you many think this is a great sign. However, a high liquidity ratio (Cash equivalent/total assets) can mean that the company is not investing and instead is just storing the money in a bank account ( which you could do without investing in the company).

A good way to assess the financial statements is to use the ‘common size statements’. These essentially just descale the numbers in the balance sheet and income statements, making the numbers percentages. This make it much easier to identify relative value.

Comments